Every day, news outlets and scientists publish reports about the looming threat of global warming. Many countries and cities already experience the effects of the warming planet in the form of severe weather patterns, like the heavy rainfall that battered California in January 2023. According to experts, this issue can be partly mitigated by achieving net-zero greenhouse gas emissions by 2050. But for some enterprises, achieving net-zero by 2050 is an insurmountable task. Carbon sequestration is a solution.

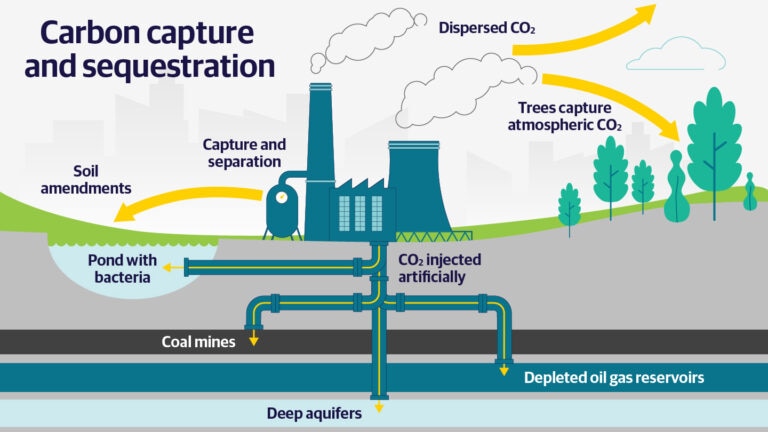

Carbon sequestration describes the process of capturing and storing carbon dioxide, the most commonly produced greenhouse gas, in order to limit its presence in the atmosphere and combat global warming.

“Where carbon sequestration comes into play is really as part of that story of transition. It’s not necessarily an end point, but it’s a way of getting to where we have to go,” said Max Horn, Vice President, Regional Product Line Manager (SPILLS) for Liberty Mutual Insurance and Ironshore.

He added, “There are a number of industries that cannot immediately decarbonize because of the processes that they require,” Horn said. “You’re taking industries that cannot immediately switch over to an alternative source of energy, such as wind or solar, and you’re allowing them to continue to operate in the short term in a way that is not producing the massive amounts of carbon dioxide that they’re currently emitting.”

According to Zoe Knight, Managing Director and Group Head of the HSBC Centre of Sustainable Finance, “We’ve had a long period when the perceived risk associated with new solutions for the climate problem has been higher than it really is. Now we’re starting to get to a point where that is tipping. It’s becoming obvious how carbon capture and storage, hydrogen, and direct-air capture are fitting into the climate equation. And therefore, finance can start to factor them into credible transition pathways for clients.”

The two major types of carbon sequestration: geologic and biologic

During geologic sequestration, carbon dioxide is converted into its liquid form using pressure and then injected into porous rock. Biologic sequestration, on the other hand, is an investment in nature’s original design for carbon capture–plant life. Plants naturally process CO2, transforming it into glucose during photosynthesis. To this end, biologic sequestration includes planting trees and encouraging the growth of other vegetation for their innate carbon storage abilities.

The concept behind carbon sequestration is not new—it was introduced by the Columbia Climate school in 1938. More than thirty years later, in 1972, Chevron tested the concept for the first time when the company injected liquid carbon into the ground in Texas. In the beginning, oil and gas companies used geologic carbon capture technology to increase production at fuel recovery sites. So, while the practice of geologic sequestration has been in use for approximately 50 years, the practice of using it to offset carbon emissions is newer.

Carbon sequestration: good for the environment and good for business

While the primary goal of carbon sequestration is to combat the devastating effects of climate change, it offers other benefits. For one, in 2022 the US government supercharged tax credit 45Q, effectively increasing the value of captured CO2 from $50 per ton to $85 per ton—a 70% change. This update to the 15-year-old tax credit incentivizes companies to reduce their carbon footprints using carbon capture, and it creates opportunities for businesses to save money while supporting a greener planet.

“You’ve increased the value of the credit, and you’ve also increased the opportunity and clarified the opportunity. And so, right now is the point where there was a tremendous land grab for carbon sequestration sites,” Horn said. “A lot more businesses see that this is a real opportunity and something that people could put extensive and very expensive investment into.”

Reduced carbon footprint can also serve as a driver of new business. Some state and federal departments prioritize working with low-carbon providers, which means carbon emission statistics can function as a key differentiator for decision-makers. This preference for green companies also extends to the B2C realm, where consumers may opt for companies and produce that prioritize the environment in their operations. Consumers more regularly consider the social and environmental practices of a product or service when making buying decisions. In 2020, Deloitte surveyed 10,000 people and found that “reducing carbon emissions was a near-universal priority” with 64% of respondents listing air pollution as a top issue.

“If you’re creating concrete and you want to sell into a state like California that has favorable contract processes for low-emission industries or low-emission businesses, that creates an opportunity for your market,” Horn offered as an example.

The importance of site selection in carbon sequestration projects

Carbon sequestration, while ultimately an important tool in the fight against climate change, is not without risk. It necessitates years of investment, including renovating facilities so they can capture and liquify CO2, building pipelines for the transport of liquid CO2, and securing proper carbon storage sites. The most important consideration in planning for carbon capture is site selection.

During the carbon sequestration process, the potential for mishap lingers. Accidental geological disruption can lead to seismic activity, resulting in carbon’s release back into the atmosphere. Selecting an appropriate site for carbon storage reduces risks. The United States has some of the greatest opportunities for CO2 storage in the world, alongside Northern Europe and China. In fact, he US has the capacity to store 3,000 metric gigatons of carbon dioxide, which is the equivalent of 2.2 trillion pounds. The ideal location for carbon storage in the United States includes the coastal basins from Texas to Georgia.

Insurance can help mitigate exposure concerns

Insurance carriers in the field of carbon capture have a deep understanding of the risk involved, including risk implications and risk management. As carbon sequestration is still a developing practice, an expert can help identify hard to spot or complex factors, ensuring a smart, safe plan and execution. Relatedly, carriers can conduct a deep analysis of the impact of transitioning to greener operations for a company.

Foresight and insight into how retrofitting facilities and securing a storage site will impact business can also save time and money. Site pollution liability and environmental protection coverage protects companies in the event that operations release CO2 or other pollutants into the atmosphere. “The release of carbon dioxide that has been sequestered is essentially a pollution incident. And so, we have a modified trigger to also cover that clawback of credits,” Horn said. Financial protection can also reduce the impact of the loss of tax credits.

The benefits of carbon sequestration outweigh the risks

Risk of exposure shouldn’t deter industries from working to combat climate change. Carbon sequestration is safe when implemented according to best practices, and climate scientists report that carbon dioxide can be stored underground for thousands of years, making it essentially a permanent solution. Explore ways to contribute to carbon reduction using carbon sequestration in our report, Carbon sequestration: options for a low-carbon future.

To learn more about how we manage environmental risk, visit our environmental liability page.

Featured insights

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.