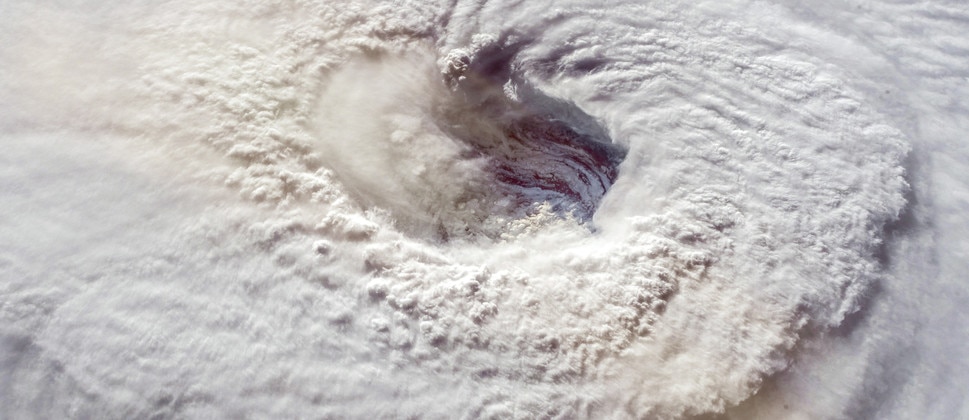

Floods

Flood action plan

Floods are one of the most common types of natural disaster and can quickly cause severe damage and loss to your business. Whether caused by rain, melting snow, or a dam failure, floods can occur in any part of the country and impact business of all sizes, so it’s important to plan to help protect your business.

Following our flood action plan can help minimize the damaging impact of an unexpected flood on your business:

- Checklists for flood preparation

- Immediate actions to take before and during a flood

- Recovery steps to take after a flood occurs

Being prepared for flooding can help minimize damage and result in quicker recovery in the event of a loss.

Related insights

Following the procedures outlined can help you mitigate the impact of severe weather. This material cannot, however, foresee every potential for loss or damage, so you should review your particular situation in an effort to identify all appropriate steps and precautions. No undertaking is intended or assumed by Liberty Mutual Insurance by this publication, as it is for informational purposes only.

Our risk control services are advisory only. We assume no responsibility for: managing or controlling customer safety activities, implementing any recommended corrective measures, or identifying all potential hazards. No attempt has been made to interpret any referenced codes, standards, or regulations. Please refer to the appropriate government authority for interpretation or clarification.

This website is intended to be informational. Descriptions are provided only as a summary outline of the products and services available and are not intended to be comprehensive and do not constitute an offer to sell or a solicitation. The products and services described may not be available in all states or jurisdictions. See your policy, service contract, or program documentation for actual terms, conditions, and exclusions. Any inquiries regarding the subject matter set forth herein should be directed through licensed insurance professionals.

Coverage and insurance are provided and underwritten by Liberty Mutual Insurance Company or its affiliates or subsidiaries. When we offer insurance products, we will state clearly which insurer will underwrite the policy. Some policies may be placed with a surplus lines insurer. Surplus lines insurers generally do not participate in state guaranty funds and coverage may only be obtained through duly licensed surplus lines brokers.