Environmental protection insurance coverage

Comprehensive general and environmental liability coverage

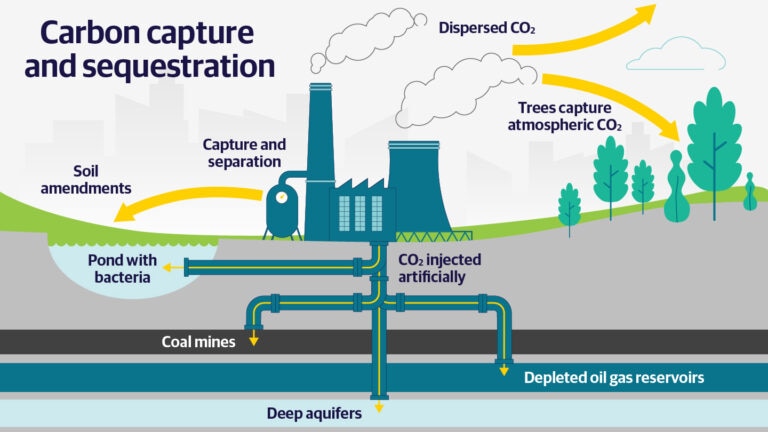

The costs and expenses associated with a general liability or an environmental liability incident can be substantial, whether related to courtroom defense, crisis communications, fines, or site cleanup.

With our environmental protection insurance coverage (EPIC) policy, you’ll get the comprehensive protection of general liability, environmental liability, and more — in a single package.

A protective partnership

Solutions for complex risks

Our EPIC package solution is designed specifically to address the general and environmental liability exposures of manufacturing, distribution, and processing operations; waste treatment, storage, and disposal facilities; and environmental consulting and contracting businesses, providing a variety of coverage options, including:

- General liability including products and products pollution

- Non-owned site pollution liability

- Contractors pollution liability

- Site pollution liability

- Professional liability

Our solutions can cover a broad spectrum of general and environmental risks from premises, operations, products, and pollution exposures. We can also complement each EPIC package solution with options for commercial auto and excess liability coverage.

Expertise that delivers

When you work with us, your business will benefit from the know-how and collaboration of our dedicated environmental casualty underwriting and claims professionals.

Offering expertise across a variety of industries, our team works together to tailor support to address your general and environmental exposures, no matter how complex or multifaceted.

Across all customer touchpoints, from when a policy is issued until a claim is resolved, our goal is the same: to help protect your business reputation and bottom line against the adverse financial impact of general liability and environmental liability incidents.

Better control over claims

When a general liability or environmental liability incident occurs, a prompt response is important. That’s why our approach to managing claims is designed to provide maximum value with minimum hassle.

Our claims professionals are closely supported by the underwriters who design our insurance programs, so they have a deep understanding of the general and environmental liability risks our customers face.

This insight, along with highly experienced senior claims leaders, ongoing training, and a culture that promotes proactive decision making, empowers our people to resolve claims promptly and with each customer’s best interests in mind.

Our environmental customers also benefit from the following support and value-added services:

- 24/7 emergency claims response hotline (1-888-292-0249)

- Rapid on-site response via our Liberty Mutual Enviro Response mobile app

- Crisis management and public relations services

- Contract review services

- Regulatory compliance assistance

- Risk mitigation consultation

Even with the most complex losses, we know how to provide a high-quality claims experience and help minimize liability so your company’s business can recover.

Get in touch

Our commercial and specialty insurance products and services are distributed through brokers and agents. If you are interested in our solutions for your business, please contact your agent or broker. If you are an agent or broker, please reach out to our team for more information.

Environmental submissions

When environmental incidents occur, a prompt response is important.

With Liberty Mutual Enviro Response, our mobile claims app, environmental customers benefit from real-time access to claims professionals and resources at the push of a button.

ExploreRelated insights

This website is intended to be informational. Descriptions are provided only as a summary outline of the products and services available and are not intended to be comprehensive and do not constitute an offer to sell or a solicitation. The products and services described may not be available in all states or jurisdictions. See your policy, service contract, or program documentation for actual terms, conditions, and exclusions. Any inquiries regarding the subject matter set forth herein should be directed through licensed insurance professionals.

Coverage and insurance are provided and underwritten by Liberty Mutual Insurance Company or its affiliates or subsidiaries. When we offer insurance products, we will state clearly which insurer will underwrite the policy. Some policies may be placed with a surplus lines insurer. Surplus lines insurers generally do not participate in state guaranty funds and coverage may only be obtained through duly licensed surplus lines brokers.