The workers compensation landscape continues to evolve due to a variety of medical, legal, and social trends. From mega claims to motor vehicle accidents and opioids, learn more about these issues and how businesses can better protect their employees and control claims costs.

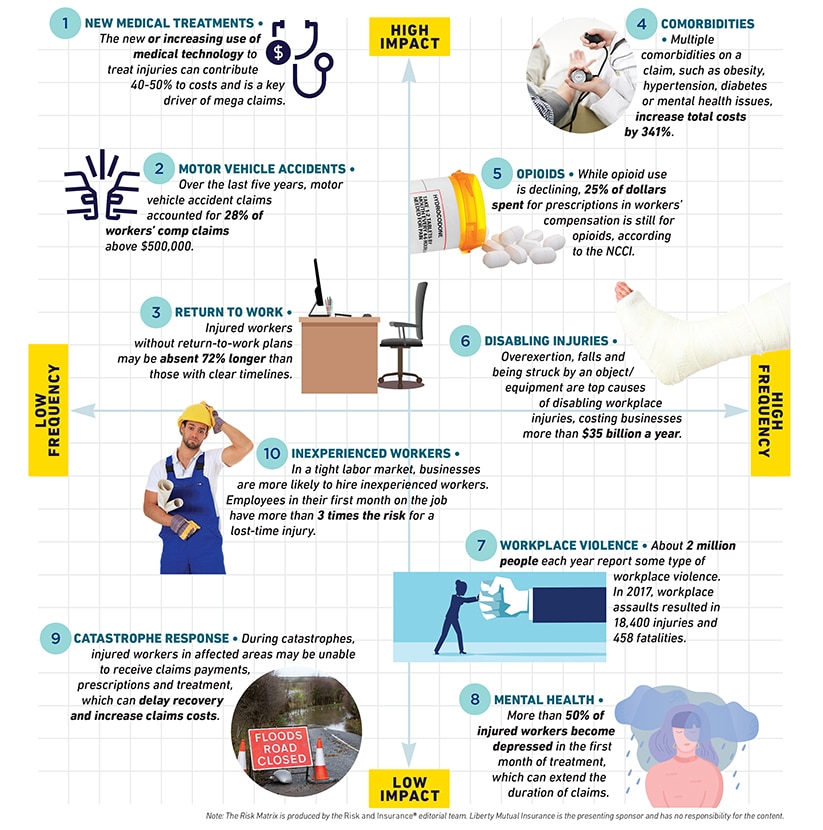

The Workers Compensation Risk Matrix featuring 10 critical risks

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots critical risks shaping the workers compensation landscape based on the frequency and severity of each risk.

New medical treatments

Technology is seen as both an asset and a disruptor in almost every industry it touches. In health care, the new and increasing use of medical technology to treat injuries—including those suffered at work— can contribute 40% to 50% to costs. Partnering with an insurer that has deep medical and workplace injury expertise can help ensure that providers follow evidenced based treatment guidelines, and recommend appropriate care.

Motor vehicle accidents

While there has been an overall decline in workers compensation claims in recent years, the frequency of claims from motor vehicle accidents (MVAs) has increased, according to the NCCI. The severity of MVA claims also has an impact—costing 80% to 100% more than the average workers compensation claim. Distracted driving, speeding, and more contribute to worker-related injuries on the road. Fleet safety is paramount to protecting drivers, vehicles, and finances.

Return to work

Serious workplace injuries continue to hurt the bottom line for employers, costing businesses more than $55 billion a year. Building a well-rounded return-to-work (RTW) program can help companies control workers compensation costs. Employers have the opportunity to partner with brokers and insurers to create an effective program that begins before injury even occurs. In fact, getting workers back on the job sooner can result in 72% fewer lost workdays.

Comorbidities

Comorbidities on a workers comp claim can increase a claim’s duration by as much as 76%. More people are living and working longer than in the past, which can increase the likelihood that a comorbid condition, like obesity, hypertension, mental illness, or addiction, will arise on a claim. For example, co-morbidities are a key driver of rising physical medicine costs, which account for as much as 30% of physician expenses in workers compensation claims.

Opioids

Opioids, because of their highly addictive nature, have caused a lot of harm in the workers comp space. And though the number of opioid prescriptions has dropped in recent years, there is still more to be done to curb their use to treat workplace injuries. Medical marijuana is one emerging treatment method that could replace opioids as pain relievers. Another strategy is to incorporate the U.S. Centers for Disease Control and Prevention guidelines into claims management. Some programs already show a 9% reduction in opioid prescriptions with the CDC guidelines in place.

Disabling injuries

Serious workplace injuries — ones that cause employees to miss five or more days of work — can add strain to a business, both in workers compensation dollars spent and in lost time. Among the top ten causes of disabling injuries at work are overexertion ($13.1 billion), falls on the same level ($10.4 billion), and being struck by an object or equipment ($5.2 billion). Understanding the root causes of the most serious workplace injuries in your specific operation is the first step in maintaining a safe workplace and better protecting employees.

Workplace violence

Because of the complexity and frequency of workplace violence today, risk managers are working to fully understand the scope of what fuels these threats, so they can more effectively identify and prioritize actions needed to safeguard their employees and businesses. There are four main types of violence in the workplace to prepare and train for: criminal intent, customer/client, worker on worker, and personal/domestic. External threats tend to pose the biggest risk.

Mental health

Mental health conditions are the most expensive health challenges in the nation behind cancer and heart disease. In workers’ comp, mental health conditions can seriously impact the cost of a “typical” claim, especially if feelings of doubt and depression settle in after the start of a claim. In fact, more than 50% of injured workers experience depressive symptoms, especially during the first month after the injury. There are several actions employers and insurers can take to identify and address psychosocial conditions in a claim, including continued communication, light-duty work opportunities, and using supportive language surrounding mental health.

Catastrophe response

Injured workers can face delays in receiving workers compensation payments, prescriptions, and even treatment after catastrophic weather events. Road closures, power outages, and other long-term impacts can delay recovery and increase claims costs. By collaborating with their insurance carriers, employers can stay a step ahead of severe weather. For example, some insurers are leveraging technology to expedite claims payments when an interruption in mail service is likely.

Inexperienced workers

With unemployment rates at historic lows, many businesses may hire less experienced staff who are performing unfamiliar tasks — some of which could be dangerous without the proper training and safety equipment. According to a recent study, employees in their first month on the job have more than three times the risk for a lost-time injury than workers who have been at their jobs for more than a year.

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.