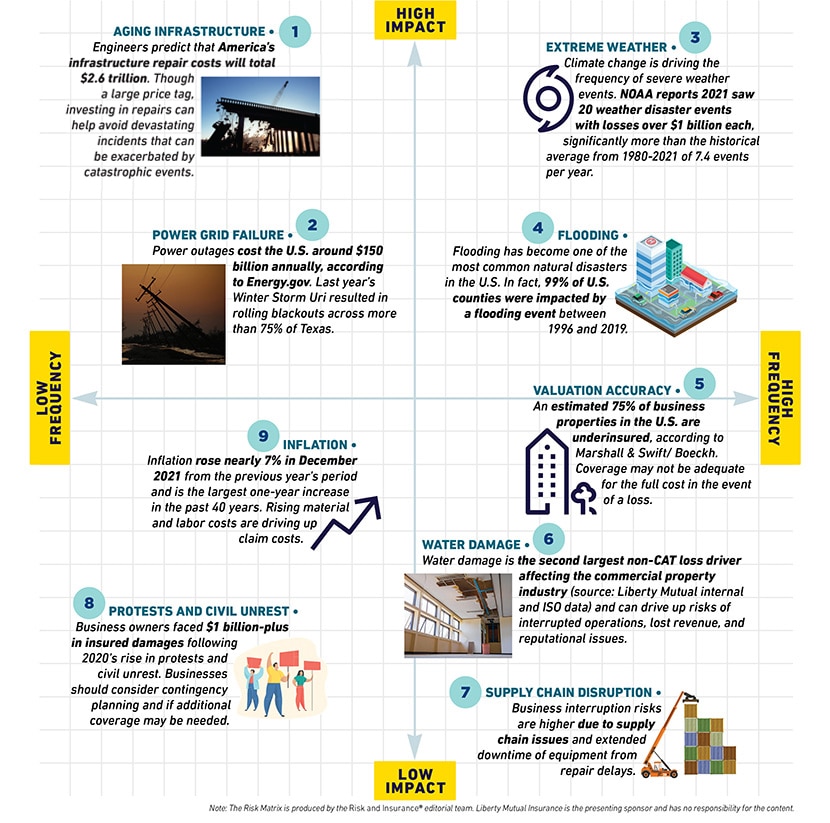

Global trends are raising the stakes on commercial property damage, including the events businesses may face, as well as the costs and challenges of recovery. Risk managers should stay informed on the risks they face and the best strategies to help anticipate and mitigate these risks.

The following Risk Matrix, produced by the editorial team at Risk & Insurance®, highlights the likely impact and frequency of critical property risks facing businesses.

Aging infrastructure

Engineers have predicted that the cost to repair America’s aging infrastructure could total $2.6 trillion. Though a large price tag, investing in repairs can avoid incidents like the Surfside Collapse in 2021, in which a 12-story beachfront condominium in Surfside, Florida, collapsed due to long-term degradation of the concrete structural supports. As a result, resilient construction is on the rise to help buildings withstand natural disasters and other ailments to infrastructure.

Power grid failure

In February 2021, Winter Storm Uri caused blackouts for more than 9.9 million people. The 2021 Dixie Fire in California started when Pacific Gas & Electric transmission lines ignited, burning nearly 1 million acres and destroying more than 1,300 homes. Power grid outages and failures cost U.S. businesses $150 billion annually. And with the risk of long-term power outages on the rise, it’s critical for organizations in every industry to consider the impact of prolonged power loss on their businesses.

Extreme weather

The National Oceanic and Atmospheric Administration (NOAA) reported 20 weather disaster events in 2021 with losses of more than $1 billion each, significantly more than the historical average from 1980-2021 of 7.4 events per year. A deeper review of how to mitigate climate-related risk is in order. Also, for properties in the line of hurricanes and tropical storms, a good risk mitigation step is to develop an action plan in the event a storm is brewing.

Flooding

Flooding has become one of the most common natural disasters in the United States, and hurricanes exacerbate the risk. In fact, 99 percent of U.S. counties were impacted by a flooding event between 1996 and 2019. With such a high chance of a flood occurring, businesses are in want of a detailed response plan to help get ahead of damage and other secondary risks.

Valuation accuracy

An estimated 75 percent of businesses in the U.S. are underinsured by 40 percent, according to Marshall & Swift/Boeckh. That means current coverage may not adequately meet the current cost in the event of a loss. This is why it is important for property owners to partner with someone who is able to truly understand their coverage needs and provide accurate valuations on the properties under their policies.

Water damage

Water damage is a leading cause of property claims for businesses. Water can wreak havoc on a business’ property assets and repairs can be costly. There’s also the added risk of business interruption, potential mold remediation, the lurking threat of bacteria that could lead to Legionnaires’ disease (or other illnesses), and more.

Supply chain disruption

According to Fortune, 94 percent of the Fortune 1000 companies saw COVID-related supply chain disruptions in 2020 and the challenges continue across sectors. Manufacturing, construction, and similar industries are feeling the pull as material shortages put a strain on pricing. Businesses waiting for replacement parts or equipment deliveries can face downtime, further increasing costs.

Protests and civil unrest

2020 saw a greater period of civil unrest, and business owners were on the receiving end of a $1 billion-plus insured damages price tag after protests turned violent and property was destroyed. In times of turbulence, businesses should review their business contingency plans for areas that require additional coverage. War and terrorism solutions, as an example, can help protect business property and provide business interruption coverage should an event disrupt operations.

Inflation

The U.S. inflation rate accelerated to an annualized rate of 8.5 percent in March 2022, the highest since December 1981, according to Trading Economics. Furthermore, last year’s inflation is considered the largest one-year increase in the past 40 years. Material and labor costs are on the rise, further driving claims costs for businesses.

Featured insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.