Private equity (PE) activity in the tech space has soared over the last decade. Data indicates that the global tech sector attracted $675 billion from PE last year, up from $100 billion in 2012. And while continued growth is anticipated, disruption by AI, ongoing macroeconomic uncertainties like fluctuating interest rates, availability of talent, ESG considerations and more are sure to all be factors that influence the sector moving forward.

I’ve previously explored cyber risk and cyber insurance needs specific to PE firms and their portfolio companies in a three-part series but given the growth and market dynamics at play in the space, it’s worth examining the property & casualty (P&C) side as well. Mark Kurland, Senior Director of Underwriting for Middle Market Multi-Industry/Technology, and Matt Henry, Director of Underwriting for Technology, work closely with my team and I in this space and joined me in this blog to explore the topic further.

The wide world of tech

Don’t let the brevity of the word “tech” deceive you. It is a big, wide word and there are distinct subsectors of the industry that PE firms make investments in, which are typically bucketed as software/IT services, manufacturing, and telecommunications.

There is a spectrum for how easily PE firms investing in these subsectors can secure P&C coverage – and it’s crucial for firms to have an awareness of the nuances for each to make informed investment decisions. For example, it is often easier to secure P&C coverage for a software investment than an electronics manufacturing investment as the former is less capital-intensive and a more straightforward due diligence process from a P&C perspective.

It’s important for PE firms to look with a finer lens at each of these subsectors and what insurance conditions to expect on the P&C lines as they consider tech industry investments:

1. Software/IT services

The industry sees most PE action in this space. Case in point, software deals made up $256 billion, or 90% of the total tech deal value in 2021. While P&C risks are present in this subsector, cyber risks and ensuring streamlined and consistent cyber controls are larger challenges.

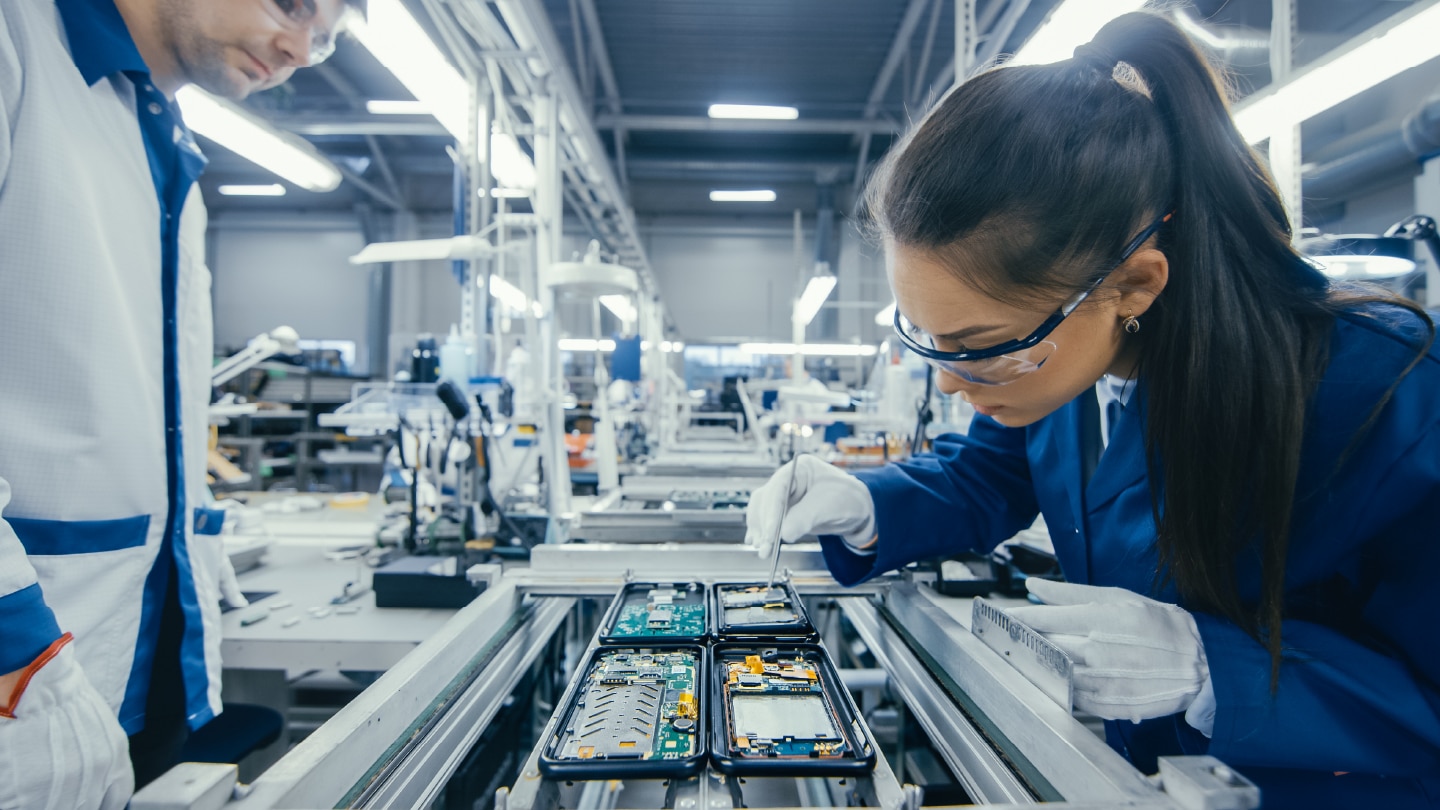

2. Manufacturing

Underwriting electronics manufacturing risks can be very challenging from a P&C perspective for a variety of reasons, such as complex property risk, products liability exposure, regulatory obligations, supply chain challenges or environmental concerns, and as a result are typically where our teams see the least amount of deal activity.

3. Telecommunications

While there has been a significant growth in PE firms’ interest in this subsector over the past several years, particularly in firms purchasing telecommunications infrastructure, it remains a challenging P&C risk. The large network footprint, decentralized property throughout the network footprint, climate concerns, etc., can make the understanding and underwriting of the risk time consuming. While securing insurance is not impossible, it does require the right carrier partner.

Filling the gaps with knowledge and holistic solutions

No matter the subsector, PE firms should think holistically about insurance for any tech companies they are eyeing or that are in their portfolios, not just in terms of siloed P&C, cyber and E&O needs. Carefully selecting an underwriting partner who is knowledgeable and takes the time to craft a bespoke solution that harmonizes multiple coverages can ease worries about any gaps. One example of that is cyber and E&O exposure where it is not uncommon for there to be questions about where losses fall among the various coverage grants across multiple P&C and financial lines policies, especially for a sector that evolves so rapidly, leaving PE firms vulnerable to risk. This is certainly a niche space and expert underwriting partners entrenched in the sector will be familiar with the nuances and able to identify and address fluctuating gaps quickly.

Five themes to anchor insurance for a tech growth strategy

So how can PE firms looking to make tech buys set themselves up for success in such a complex industry and risk environment? While it’s true that what makes a risk good is different across the three different tech subsectors of software/IT services, manufacturing and telecommunications, there are five universal themes that PE firms can ground their insurance strategy in, no matter the investment, including:

Relationships

It’s important for there to be a true partnership between a PE firm and its underwriting team so the carrier can understand the firm’s strategy and business model. Bringing a carrier along on the growth journey ensures there are no surprises on the types of investments made and that insurance doesn’t hold up a deal.

Expertise

As we explored above, awareness of gaps, particularly when a product has the capability of causing injury and damage, and detailed knowledge of the tech industry are imperative. Risk control expertise in evaluating Property, Work Comp and Products liability is critical in the manufacturing segment.

Speed

Time is always of the essence. Ensure that the intricate coverages, like cyber and E&O, take precedent during the transaction.

Transparency

Not all carriers work across every subsector of tech. If a firm is focused on investing in tech, whether in software, manufacturing or telecom, they need to know what their carrier partners are willing and able to write.

Advisory

PE firms can benefit greatly when they shift their mindset about insurance and look at their carriers as an advisory resource rather than solely as a transactional necessity. A savvy risk and insurance team can help problem solve with creative solutions that impact the overall health and growth of a portfolio.

Looking to the future

For PE firms looking to invest in tech – or that already have tech companies in their portfolios – it’s imperative to be aware of current market conditions and recognize the nuanced approach needed to successfully mitigate risk and secure adequate insurance coverage. Different tech subsectors need a bespoke approach, but keeping in mind common elements – solid relationships, expertise, ability to move quickly, transparency and a shift in mindset – that can be applied across the insurance approach of any investment sets up a PE firm up for growth and success.

To learn more about how Liberty Mutual manages these and other risks, visit our private equity and tech industry pages.

Bringing more to the middle

Our dedication to knowing the nuances of the industries we target is just one reason to partner with Liberty Mutual for your middle market needs. With a steady appetite, essential products, and the advantages of a global company, we’re ready to place your business.

Learn moreGet in touch

Our commercial and specialty insurance products and services are distributed through brokers and agents. If you are interested in our solutions for your business, please contact your agent or broker. If you are an agent or broker, please reach out to our team for more information.

Amy Gross

Boston, MA

Mark Kurland

Featured insights

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.