From adjusting supply chains to evolving business operations, businesses are adapting in different ways as a result of the coronavirus pandemic. Learn more about some key shifts that are taking place as part of the “new normal” and ways your company can help mitigate risk.

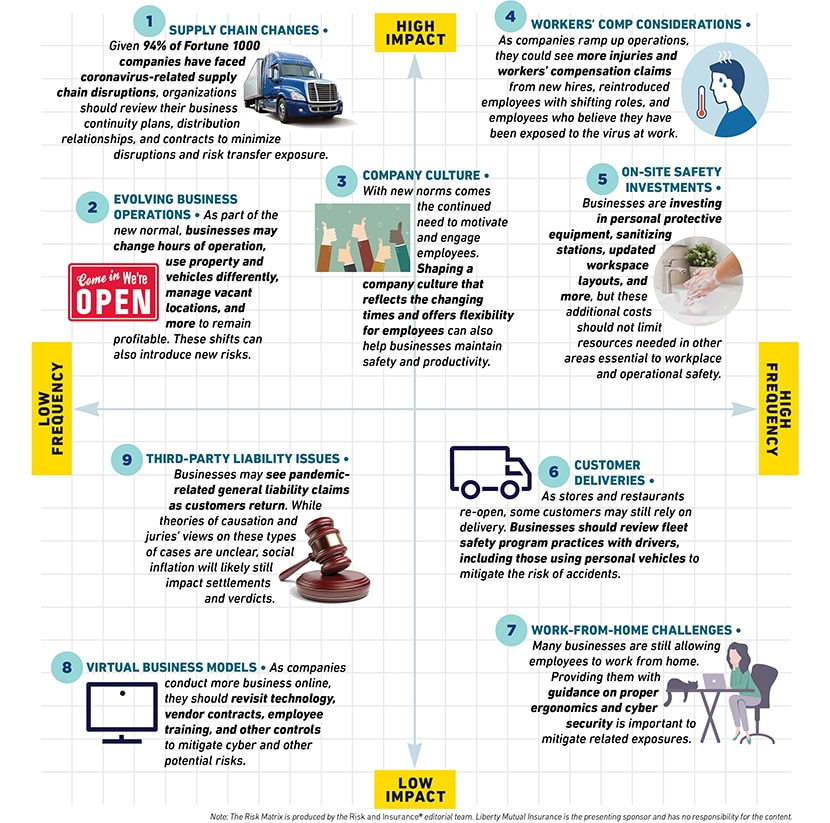

The New Normal Risk Matrix featuring 9 ways businesses could change as a result of COVID-19

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots ways businesses could respond to the COVID-19 pandemic based on frequency and severity.

Supply chain changes

As COVID-19 spread, many companies had to close or downsize in order to comply with social distancing mandates, which stalled operations across a variety of industries. As a result, 94% of Fortune 1000 companies experienced some type of coronavirus-related supply chain disruption. As businesses adapt to the “new normal,” they should proactively plan how to mitigate potential disruptions, whether as a result of natural disasters, pandemics, cyber threats, or other causes. Companies that establish business continuity plans, understand their supply chain partners’ operations, and reduce risk through contracts and insurance, will likely be in better positions to respond and recover.

Evolving business operations

As a result of the pandemic, many businesses are changing hours of operation, using property and vehicles differently, managing vacant locations, and making other adjustments to remain profitable. These shifts can also introduce new risks that companies should identify and address to help maintain productivity and protect employees and customers. Staying up to date with and adhering to guidance from the Centers for Disease Control and Prevention and state and municipal departments of health are critical to helping reduce the spread of COVID-19. Other key areas that employers should keep in mind as they return to operations include proactively supporting the health and well-being of employees, establishing routine cleaning of facilities; verifying that building systems and equipment are fully functional; and reviewing supplier relationships, readiness, and contracts.

Company culture

With new norms comes the continued need to motivate and engage employees. Shaping a company culture that reflects the changing times and offers flexibility for employees can help businesses maintain safety and productivity. By encouraging frequent handwashing, making sanitizing workstations and other personal protective equipment available, and implementing social distancing measures, a company can demonstrate its commitment to staff safety and well-being — a key area to address when resuming business operations. Showing support for employees in difficult times can help solidify a company culture based in trust and respect.

Workers compensation considerations

As companies ramp up or adapt their operations, they could see more workers compensation-related injuries and claims. New, untrained hires learning new processes and equipment may be more prone to accidents while returning employees may make more mistakes as they re-adapt to their work environments. As employees return, there could also be claims from those who believe they have been exposed to the virus at work. While the impact on claims and costs is still unknown, disabling workplace injuries cost U.S. businesses more than $59 billion annually — or more than $1 billion per week. To help better protect employees and minimize the financial impact during this unprecedented time, companies should understand the top causes of injuries and focus efforts on improving safety in their operations.

On-site safety investments

As companies begin to reopen, they face several operational challenges to protect staff and visitors. In addition to following guidance from the Centers for Disease Control and Prevention, state, and local health authorities, businesses should invest in personal protective equipment, sanitizing stations, updated workspace layouts, and more. Implementing cleaning, workplace monitoring, and other safety measures is also critical to helping reduce the spread of the virus. However, these additional investments should not limit resources needed in other areas essential to workplace and operational safety.

Customer deliveries

At the onset of the pandemic, “stay-at-home” orders became commonplace across the U.S., limiting opportunities for people to secure necessities. To meet the growing need, many grocery stores and restaurants expanded their delivery services. Now that restrictions have lifted, these establishments are in different stages of welcoming patrons back. However, some customers may still prefer delivery. Businesses should review fleet management practices, such as screening drivers and establishing standards for personal vehicle use, to help mitigate commercial auto losses.

Work-from-home challenges

Even as many businesses reopen, many employers have decided to extend work-from-home (WFH) options for employees through the fall, the end of the year, or longer to protect the safety of employees. In fact, according to a recent survey, 67% of respondents expect work-from-home policies will remain in place permanently or at least for the long term. While offering WFH options can provide employees more flexibility to balance work with taking care of themselves and their families, companies should continue to provide proper guidance on ergonomics and cyber-security to help mitigate related exposures.

Virtual business models

For many companies, conducting business online is not new, but COVID-19 has certainly brought this form of connection to the forefront. But this shift can also lead to greater risk. As companies conduct more business online, they should revisit technology, vendor contracts, employee training, and other controls to help mitigate exposures such as hacking, phishing, and other cyber risks. With many employees continuing to work from home, businesses should use secured virtual private network (VPN) systems to help protect computers, cell phones, and any other remote technology being used for the company business.

Third-party liability issues

Businesses may see pandemic-related general liability claims as customers return. In recent years, loss severity in general liability has been driven in large part by social inflation — the theory that societal and legal factors are helping to drive more, and bigger, lawsuits. While theories of causation and juries’ views on COVID-19 liability is difficult to predict at this point, where liability is found, social inflation will likely still impact settlements and verdicts. Keeping pace with the factors driving increases in liability claims and costs and understanding how the right insurer can use claims, legal, and other strategies to help limit the impact on customers are critical.

Related insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.