Contractors environmental legal liability

Managing construction environmental liability

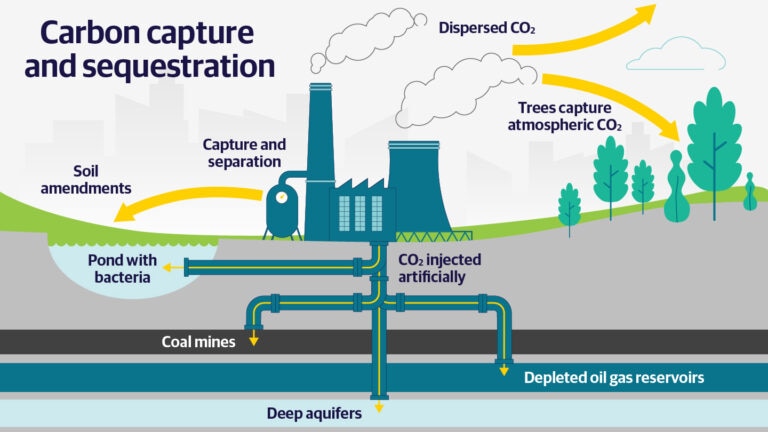

Environmental issues can arise during any major project, leaving contractors vulnerable to claims of legal liability. Even in the most favorable circumstances, liability claims related to asbestos, mold, or lead can create financial hardship and derail a project’s success.

Our contractors environmental legal liability (CELL) solution helps protect contractors against these complex exposures that can threaten a contractor’s bottom line and reputation.

A protective partnership

Solutions for complex risks

Our CELL coverage provides occurrence-based innovative solutions for a variety of pollution risks facing contractors and consultants.

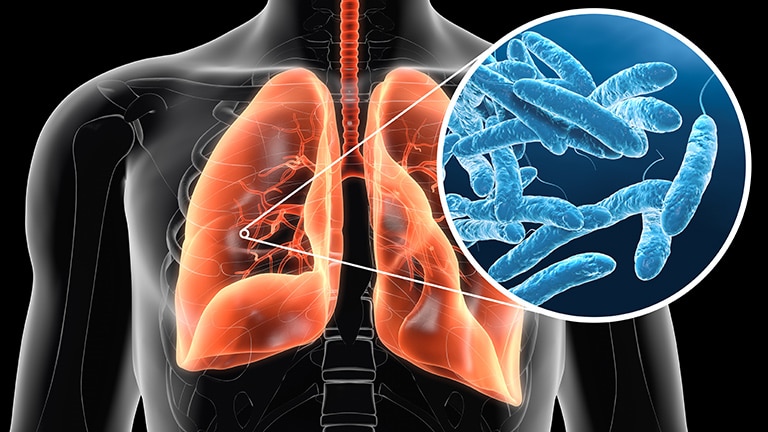

CELL helps manage environmental risks, including third-party bodily injury, property damage, and cleanup after a pollution incident. Then we go the extra mile by providing contractors with tailored coverage for their broad spectrum of pollution exposures, including transportation, non-owned locations, mold, and legionella.

Additional coverage highlights include:

- Emergency response expenses without a sublimit

- Time-element site pollution with gradual coverage available

- Coverage for image restoration, disinfection event, and pre-claim event expenses

- No professional exclusion; coverage can be added via endorsement for certain classes.

- Defense outside the limit without a sublimit

- Can be written on a practice, project, or wrap-up basis

Expertise that delivers

Contractors benefit not just from our specialized coverage, but from the collaboration and knowledge-sharing between our underwriting and claims professionals.

Whether it’s for project-specific, owner-controlled, or contractor-controlled insurance programs, our experts know that in order to protect effectively against environmental liability, you need holistic, specialized solutions.

Our teams work together — from program design and incident response to crisis management and claims assistance — to address your complex environmental risk-management needs.

Better control over claims

After an environmental incident occurs on a job site, we know that a prompt response is important. Our claims management approach is designed to provide crucial support when you need it most.

Our claims professionals work closely with our environmental underwriters, so they have in-depth understanding of environmental risks and our customers’ specific operations, projects, and insurance programs.

In addition, we support claims teams with highly skilled senior claims leaders, ongoing training, and a culture that promotes proactive decision making, so they are empowered to resolve claims quickly and with each customer’s best interests in mind.

Our environmental customers also benefit from the following support and value-added services:

- 24/7 emergency claims response hotline (1-888-292-0249)

- Rapid on-site response via our Liberty Mutual Enviro Response™ mobile app

- Crisis management and public relations services

- Contract review services

- Regulatory compliance assistance

- Risk mitigation consultation

Our claims management approach is designed for maximum value and minimum hassle so your business can quickly respond to environmental incidents and get your projects back on track.

Get in touch

Our commercial and specialty insurance products and services are distributed through brokers and agents. If you are interested in our solutions for your business, please contact your agent or broker. If you are an agent or broker, please reach out to our team for more information.

Michael Delmore

St. Louis, MO

When environmental incidents occur, a prompt response is important.

With Liberty Mutual Enviro Response, our mobile claims app, environmental customers benefit from real-time access to claims professionals and resources at the push of a button.

ExploreRelated insights

This website is intended to be informational. Descriptions are provided only as a summary outline of the products and services available and are not intended to be comprehensive and do not constitute an offer to sell or a solicitation. The products and services described may not be available in all states or jurisdictions. See your policy, service contract, or program documentation for actual terms, conditions, and exclusions. Any inquiries regarding the subject matter set forth herein should be directed through licensed insurance professionals.

Coverage and insurance are provided and underwritten by Liberty Mutual Insurance Company or its affiliates or subsidiaries. When we offer insurance products, we will state clearly which insurer will underwrite the policy. Some policies may be placed with a surplus lines insurer. Surplus lines insurers generally do not participate in state guaranty funds and coverage may only be obtained through duly licensed surplus lines brokers.