Introduction

The COVID-19 pandemic continues to influence our personal and professional lives. Almost a year into the pandemic, businesses have had to adapt – and often re-adapt – to the shifting circumstances and conditions in the marketplace. Here are 10 trends that are still evolving as a result.

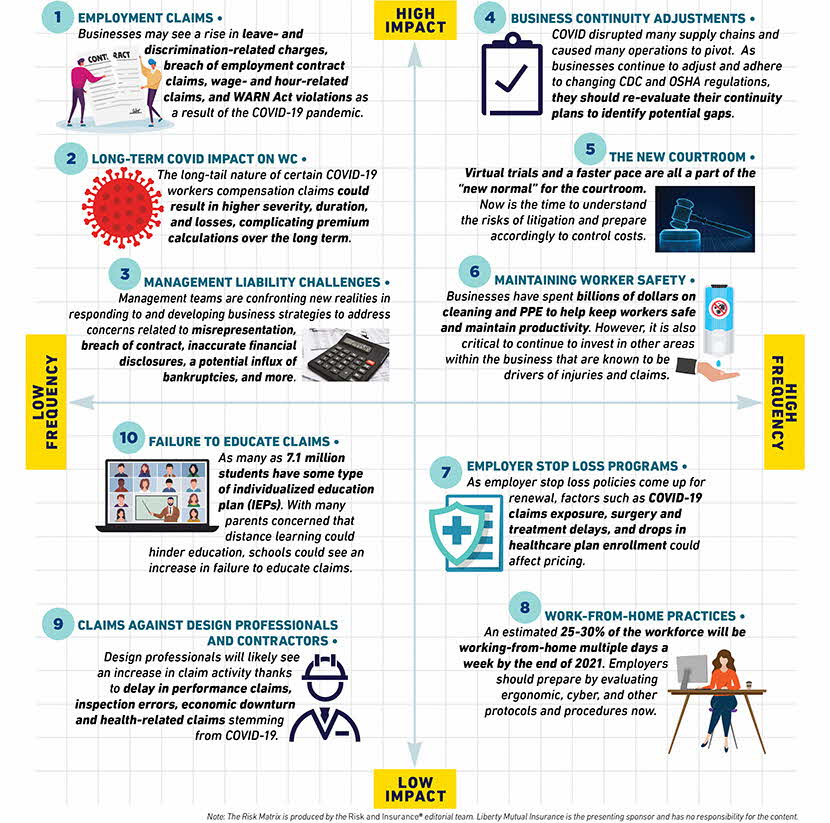

The New Normal 2.0 Risk Matrix featuring 10 areas that can leave businesses exposed due to COVID-19.

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots 10 evolving risks and challenges that businesses continue to face during the pandemic, based on frequency and severity.

Employment claims

COVID-19 ushered in a “new normal” for everyone. No industry has been left untouched by the pandemic, and it’s likely that no industry will be immune to employment claims that could stem from the virus. From February 2020 to January 2021, a total of 1,534 employment litigation cases have been filed. Employers should be on the lookout for four types of claims — leave- and discrimination-related charges, breach of employment contract claims, wage- and hour-related disputes, and WARN Act violations.

Long-term COVID impact on WC

At this moment, it’s hard to determine the long-term effects that COVID-19 will have on our communities and businesses. In workers compensation, it is likely that some COVID-19 claims could have long-tail implications, where the full impact and recovery time for the virus will be hard to gauge. One study found that 10% of COVID patients experience prolonged symptoms, with 87% reporting persistence of at least one symptom. Knowing how the virus is continuing to have long-term affects on patients could increase claim duration and create new workplace risk.

Management liability challenges

The hardening of the management liability market has accelerated alongside other commercial lines since the onset of the virus. Management teams are grappling with addressing COVID-related D&O concerns as they pertain to misrepresentation, breach of contract, inaccurate financial disclosures, the potential risk of bankruptcies, and more. There is an expectation that there will be heightened competition for professional liability coverage to be deployed moving forward.

Business continuity adjustments

Many supply chains are complex and cross several borders, making them harder to manage during a global pandemic that limited travel and caused shutdowns in some places. According to a recent survey, 94% of the Fortune 1000 companies saw coronavirus supply chain disruptions. OSHA and the CDC are continuously updating guidelines to help keep workers safe during this uncertain period. Now is the time for businesses to review their supply chain risk and get formal business continuity plans in place that consider partner operations, build in contingencies, and prioritize product safety.

The new courtroom

Litigation has seen some massive changes as social distancing dictates that all parties remain six feet away from each other. Although shifting to virtual litigation over the last several months has had some benefits, while creating new challenges to navigate through. Cases are coming to trial faster thanks to the virtual setting, but trials are limiting their jury pool thanks to the new technology requirements, such as regular access to internet and a computer. Although there has been a slowdown in the number of cases before courts, nuclear verdicts continue to be a factor in the casualty space.

Maintaining worker safety

As a result of the pandemic, businesses have shifted their efforts to maintain safety and productivity. In fact, hundreds of thousands to even billions of dollars have been spent on personal protective equipment, hand sanitizer, increased cleaning efforts, and more. These investments, while critical in the short-term to provide a safe work environment, should not be the only area of focus. Other drivers of injuries, claims and loss are still prevalent in the workspace and cannot be disregarded during the COVID pandemic.

Employer stop loss programs

As employer stop loss policies come up for renewal, factors such as COVID-19 claims exposure, surgery and treatment delays, and drops in health care plan enrollment could affect pricing. Insurers will likely have to adjust their “normal” annual inflation factors to reflect the expected incremental change from COVID-19.

Work-from-home practices

With so much of the workforce operating from home, and a predicted 25-30% of the workforce anticipated to stay there through 2021, employers need to evaluate their work-from-home policies to meet the growing demand for this form of work. Successfully adapting business operations and maintaining productivity will require a commitment to safety and wellbeing. Reviewing ergonomic, cyber, and other standards while workers are in home settings is key.

Claims against design professionals and contractors

In the wake of COVID-19, there’s an anticipated rise of claim activity against architect and engineering design firms and professionals. Many are anticipating complaints on delays in performance of services stemming from stay-at-home orders, economic downturn causing owners/investors to allege faulty design and displace blame for backing out of projects due to financial loss, and health-related claims stemming from COVID.

Failure to educate claims

With nearly 7.1 million students relying on an individualized education plan (IEP), the pandemic has disrupted the flow of education. IEPs often require hands-on therapies for students with functional needs, but distance learning has made this challenging. Failure to educate claims could be on the rise as a result. Taking a proactive approach, which includes reaching out to families with IEPs, establishing a process for students, and notifying carriers as issues emerge, could help mitigate this risk for schools.

Related insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.