Introduction

Supply chain disruptions can affect a business in a variety of ways. Here are 10 issues companies are facing because of current supply chain challenges.

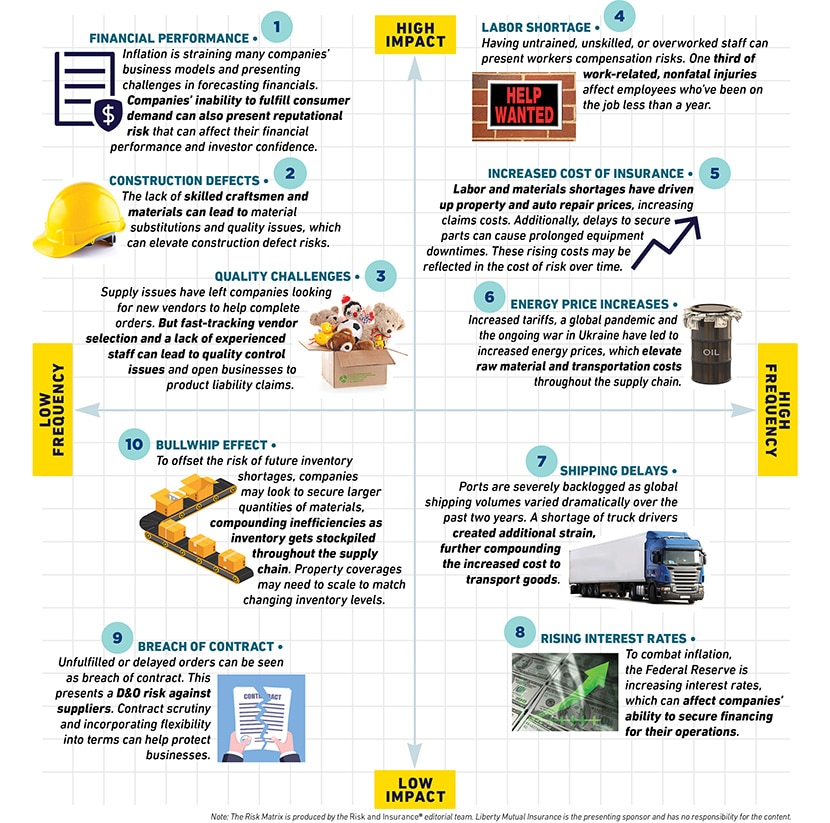

The following Risk Matrix, produced by the editorial team at Risk & Insurance®, highlights the likely impact and frequency of 10 critical issues stemming from supply chain disruption.

Financial performance

In 2021, supply chain disruptions cost businesses worldwide an average of $184 million annually, an estimated $228 million in the U.S., and supply chain challenges continue to impact companies’ financial performance as a result of several factors. Inflation is straining many companies’ business models and presenting challenges in forecasting financials. In addition, higher costs, shipping slowdowns, and labor shortages are also making it harder to meet customer demand, which can impact investor confidence as well as a business’ reputation and bottom line.

Construction defects

The construction industry faces an unprecedented number of complex exposures. With fewer workers entering the construction industry, and retirees exiting, the industry itself is facing a 650,000 worker deficit. In addition, material costs are on the rise, jumping 20 percent from June 2021 to June 2022. To address these issues, contractors may hire less experienced workers or consider substituting materials. However, these decisions can lead to quality issues and elevate the risk of construction defects and related claims. Explore three strategies construction risk managers can implement to help reduce risk across the supply chain.

Quality challenges

Supply chain issues have left companies looking for new vendors to help complete orders; however, fast-tracking vendor selection can lead to quality control issues and open businesses to product liability claims. In addition, many companies often overlook secondary and tertiary suppliers, but rethinking the importance of these and other vendors can help protect you during times of turbulence. Here are four risk mitigation measures companies can take to offset some of the supply chain disruption and help keep operations running.

Labor shortage

A historic labor shortage caused by long-term factors and pandemic disruption is affecting almost all industries. The era, dubbed the Great Resignation, has left industries across the board feeling the pinch. U.S. employers reported 11.3 million job openings in May and the unemployment rate is at 3.6 percent — the lowest since February 2020. As companies look to fill open positions, there are several risks to keep in mind. Having overstrained, absent, or untrained workers can carry insurance risks, from increased injuries and professional and product liabilities to more auto accidents and damaged equipment. Here are five ways companies can navigate the current labor shortage and help mitigate risk.

Increased cost of insurance

Supply chain issues can impact businesses’ abilities to operate and the valuation of their risks. Labor and materials shortages have driven up property and auto repair prices, increasing claims costs. Additionally, delays to secure equipment parts can cause prolonged downtimes. These impacts may be reflected in the cost of risk over time. Businesses should review their operations and processes, including employee training, contingency planning, and supplier relationships, to help mitigate potential risks.

Energy price increases

For the energy sector, the last few years have been consumed by supply chain issues resulting from the COVID-19 pandemic, increased tariffs, and conflicts centered in Ukraine and China. Delays of up to 12 to 18 months are not unheard of; two-year wait times on new trucks and other specialty vehicles have become the norm; and long lead times obtaining oil and gas drilling equipment have left operations at a standstill. To keep businesses running, many energy companies have found workarounds — but some of these bring new risks. Here are five ways the energy sector can mitigate risk and persevere.

Shipping delays

Delayed shipments are placing a strain on businesses worldwide, and costs to transport goods are increasing in tandem. For perspective, trucking costs increased more than 36 percent in 2021 due to bottlenecked materials and ports as well as surging customer demand. Getting a handle on what’s behind the shortages and finding ways to help industries move forward are top of mind for risk professionals.

Rising interest rates

The Federal Reserve Board recently enacted its second consecutive 0.75 percentage point interest rate increase , all in an effort to slow inflation. But these rate hikes can affect companies’ abilities to secure financing for their operations.

Breach of contract

Supply chain and labor shortages create situations where companies may not be able to fulfill orders and meet their contractual obligations. This can put suppliers at risk for breach of contract and can create directors and officers liability exposures. Proactively managing contracts and incorporating flexibility into terms can help businesses mitigate this risk.

Bullwhip effect

To offset the risk of future inventory shortages, companies may look to secure larger quantities of materials. However, this can compound inefficiencies as inventory gets stockpiled throughout the supply chain. Manufacturers, wholesalers, and retailers can also face a range of other supply chain-related exposures as they pivot operations, from employee burnout and recalls to cyber risks and shipping delays.

Featured insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.